Malaysia has rapidly emerged as a key destination for medical tourism in the Asia-Pacific region. Over the past decade, the country’s medical tourism industry has experienced remarkable growth, attracting patients from around the world. This article explains the situation of Malaysia’s medical tourism over the past ten years, the factors behind its success, the current state, and future prospects.

Development of Medical Tourism

The Malaysian government has been promoting medical tourism through policies since the late 1990s.

In 1998

The Malaysian government established a national committee to promote medical tourism. This committee consisted of representatives from the Ministry of Health, Ministry of Tourism, Association of Private Hospitals of Malaysia (APHM), Malaysia Airlines, and the Malaysian Tourism Association.

Early 2000s

The government recognized medical tourism as an important area for economic growth and began active promotion. During this period, private hospitals such as Prince Court Medical Centre and Gleneagles Hospital began to seriously accept foreign patients.

In 2005

The Malaysia Healthcare Travel Council (MHTC) was established to promote and regulate medical tourism. MHTC developed and implemented strategies to position Malaysia as the “Healthcare Hub of Asia”.

In 2009

The government announced the “Economic Transformation Program”, which positioned medical tourism as one of 12 national key economic areas. This accelerated investment in medical tourism.

2010s

Environmental improvements were made to accept foreign patients, such as the introduction of medical visas and tax incentives. For example, a special 6-month visa was introduced for medical visitors.

In 2011

MHTC was formally established under the Ministry of Health, creating a stronger promotion system. In this year, the number of medical visitors exceeded 580,000, a 47% increase from the previous year.

In 2013

The “Malaysia International Healthcare Travel EXPO 2013” was held. Over 1,300 key investors in the medical tourism industry gathered, promoting interaction within the industry.

In 2014

Malaysian private hospitals won multiple awards at the “IMTJ Medical Travel Awards 2014”. Gleneagles Kuala Lumpur won the “International Hospital of the Year” award, Imperial Dental Specialist Centre won the “International Dental Clinic of the Year” award, and Prince Court Medical Centre won the “International Fertility Clinic of the Year” award.

2015 onwards

Focus on attracting patients from Islamic countries. Halal-certified medical services and services considerate of Islamic customs were strengthened. Major medical groups such as KPJ Healthcare Group and Sime Darby Healthcare have taken leadership in this area.

Situation over the Past 10 Years

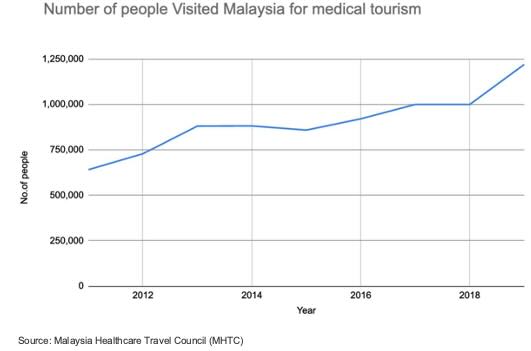

Due to government policy implementation, Malaysia’s medical tourism industry has experienced rapid growth since the 2010s. The number of foreign patients steadily increased from 2011 to 2019. The number of foreign patients, which was 641,000 in 2011, increased to 728,800 in 2012. It further increased to 881,000 in 2013, and remained almost the same at 882,000 in 2014. In 2015, it slightly decreased to 859,000, but increased again to 921,000 in 2016. In 2017 and 2018, it exceeded 1 million, and in 2019, it reached a record high of 1,220,000. Over these nine years, the number of foreign patients approximately doubled, demonstrating the rapid growth of Malaysia’s medical tourism industry.

This growth is also evident in terms of revenue. Revenue from medical tourism increased from 954 million ringgit (about 201 million USD) in 2015 to 1.7 billion ringgit (about 374 million USD) in 2019, nearly doubling in just four years.[8] The compound annual growth rate (CAGR) from 2015 to 2019 reached 16.3%, indicating the rapid development of Malaysia’s medical tourism industry.[6]

Factors for Success

There are several key factors contributing to the success of Malaysia’s medical tourism:

- Strong Government Support

The Malaysian government has positioned medical tourism as a crucial area for economic growth and actively supports it. In 2009, they established the Malaysia Healthcare Travel Council (MHTC) to centralize the promotion and regulation of medical tourism.[7] - High-Quality Medical Services

Malaysian medical institutions have obtained international certifications and introduced the latest medical technologies. This enables them to provide world-class medical services.[2] - Cost Competitiveness

Malaysia offers high-quality medical services at significantly lower costs compared to developed countries. This is particularly attractive to patients from Asian countries.[4] - Geographical Advantage

Malaysia is centrally located in the Asia-Pacific region, making it easily accessible from many countries. The high number of patients from Indonesia is due to geographical proximity and cultural similarities.[8] - Multilingual Support

As a multi-ethnic nation, Malaysia’s medical staff can often communicate in multiple languages including English, Malay, and Chinese. This facilitates smooth communication with foreign patients.[7] - Synergy with Tourism

Malaysia is also popular as a tourist destination with beautiful nature and rich culture. Combining medical treatment with tourism makes it a more attractive option for patients and their families.[5]

Current State of Medical Tourism

Since 2020, Malaysia’s medical tourism industry has been significantly impacted by the COVID-19 pandemic. However, post-pandemic recovery has been faster than expected, and the industry is rapidly bouncing back. In 2020, the number of medical tourists decreased to 689,000, but this includes patients who entered before travel restrictions and those staying under the Malaysia My Second Home program. [6] In 2022, revenue from medical tourism reached 286 million USD, significantly exceeding the Malaysia Healthcare Travel Council (MHTC)’s target of 170 million USD.[8] In the first half of 2023 alone, revenue from medical tourism recorded 190 million USD, growing at a pace that matches or exceeds the 2019 record.

The breakdown of major medical services is as follows:

- Oncology: 489.2 million USD (estimated for 2024)

- Orthopedic treatments: 445.9 million USD (estimated for 2024)[4]

Regarding the countries of origin of patients, Indonesia is the largest market, accounting for 70-80% of the total. Other major countries include Middle Eastern countries such as Saudi Arabia and UAE, Australia, Japan, Singapore, and the UK, with visitors of different religions including Muslims, Buddhists, Hindus, and Christians.

Future Prospects

Malaysia’s medical tourism industry is expected to continue steady growth. Here are the main predictions and prospects:

- Market Size Expansion

Malaysia’s medical tourism market is predicted to grow at a CAGR of 14.6% from 2024 to 2034, reaching 7.54 billion USD by 2034.[4] - Economic Ripple Effects

In 2024, revenue from medical tourism is expected to reach 2.4 billion ringgit (about 500 million USD), with an economic ripple effect of 9.6 billion ringgit (about 2.1 billion USD) on other industries such as hospitality and transportation.[3] - Increase in Patient Numbers

The Malaysia Healthcare Travel Council (MHTC) anticipates a further increase in patient numbers in 2024. In particular, an increase in patients from China and India is expected.[3] - Growth in Specific Fields

The oncology field is predicted to grow at a CAGR of 16.5% from 2024 to 2034, reaching 2.24 billion USD by 2034.[4] This is due to the increasing cancer incidence rate associated with lifestyle changes and an aging population, leading to a higher demand for early detection and treatment through cancer screenings. The Malaysian government’s “National Cancer Control Strategic Plan” for 2021-2025 is promoting a comprehensive approach to cancer treatment at the national level. This has led to improved cancer treatment infrastructure and human resource development, attracting patients from abroad seeking advanced treatments. Moreover, Malaysia offers relatively affordable treatments compared to developed countries, leading to an increase in cancer patients from neighboring countries. - Increase in Male Patients

Male patients are expected to occupy a large proportion of the medical tourism market, estimated to account for 61.7% of the market in 2024. Especially in Middle Eastern and some Asian countries, men tend to have decision-making power regarding family health, making them more likely to choose overseas travel for their own treatment. There’s also an increase in men combining business trips with medical tourism, pushing up the proportion of male patients. In light of this situation, Malaysian medical institutions are actively promoting specific treatments and health packages for men, contributing to the increase in male patients. - Long-term Growth

The medical tourism industry is predicted to grow to a scale of 5.1 billion USD by 2028. In particular, the cosmetic surgery field is expected to account for about 17% of the total.[5] - Continued Government Support

The Malaysian government plans to continue supporting medical tourism as an important area for economic growth. Further measures such as relaxation of visa regulations and promotion of investment in medical institutions are expected.[3] - Technological Innovation

The introduction of AI technology and telemedicine is expected to further improve the quality and efficiency of medical services. This may further enhance Malaysia’s competitiveness.

Malaysia’s medical tourism industry is rapidly recovering from the impact of the COVID-19 pandemic and is expected to continue steady growth. By leveraging its strengths such as strong government support, high-quality medical services, and cost competitiveness, while also addressing new challenges, Malaysia is likely to further strengthen its position as a leader in medical tourism in the Asia-Pacific region.

<Reference>

1) Alvarez & Marsal. (2024). Malaysia Medical Tourism report. Retrieved from https://www.alvarezandmarsal.com/sites/default/files/2024-04/Malaysia%20Medical%20Tourism%20report%20-%20revised%20-%20April%2024,%202024.pdf

2) Gopalan, N., Jamil, N. A., & Bakar, N. A. (2023). International medical Tourists’ expectations and behavioral intention towards Malaysian medical tourism. PLOS ONE, 18(9), e0290214. https://doi.org/10.1371/journal.pone.0290214

3) Klijs, J., Ormond, M., Mainil, T., Peerlings, J., & Heijman, W. (2016). A state-level analysis of the economic impacts of medical tourism in Malaysia. Asian-Pacific Economic Literature, 30(1), 3-29. https://doi.org/10.1111/apel.12132

4) Statista. (2024). Number of medical tourists to Malaysia 2014-2023. Retrieved from https://www.statista.com/statistics/1013809/medical-tourists-numbers-malaysia/

5) Vietnam Plus. (2024). Malaysia expects higher revenue from health tourism in 2024. Retrieved from https://en.vietnamplus.vn/malaysia-expects-higher-revenue-from-health-tourism-in-2024-post279596.vnp

<Citation>

[1] https://www.statista.com/statistics/1013809/medical-tourists-numbers-malaysia/

[2] https://en.wikipedia.org/wiki/Medical_tourism_in_Malaysia

[3] https://en.vietnamplus.vn/malaysia-expects-higher-revenue-from-health-tourism-in-2024-post279596.vnp

[4] https://www.factmr.com/report/malaysia-medical-tourism-market

[5] https://www.linkedin.com/pulse/future-medical-tourism-malaysia-51-billion-industry-jr-elliott-jr-

[6] https://pmc.ncbi.nlm.nih.gov/articles/PMC11316254/

[7] https://pmc.ncbi.nlm.nih.gov/articles/PMC10559008/

[8] https://www.alvarezandmarsal.com/sites/default/files/2024-04/Malaysia%20Medical%20Tourism%20report%20-%20revised%20-%20April%2024,%202024.pdf